Cooperation, rather than conflict, can shape the management of co-parenting expenses. Our comprehensive guide covers everything you need to know about co-parenting finances. Learn about shared expenses and budgeting and read expert advice on how to prevent common issues.

Inside this article:

Shared expenses in child custody refer to any child-raising costs that co-parents share. Co-parents divide and share the expenses according to their agreed-upon arrangement. Common expenses include unreimbursed medical bills, electronics, entertainment, and personal care.

After a separation or divorce, both parents have financial obligations to raise and provide for their child or children. Shared expenses are distinct from child support , where one parent pays another to support fundamental expenses.

"Money can sometimes create discomfort, but it shouldn't overshadow the focus on the child's well-being," says Jennifer Warren Medwin, MS, CDC and Florida Supreme Court Certified Family Mediator , “How co-parents divide shared expenses may vary, but it should always be fair and equitable. It's crucial to emphasize that fairness doesn't always equate to a 50/50 split. The key is to maintain a mentality of teamwork for the sake of your children." Medwin specializes in people contemplating divorce or hoping to save their marriage.

Co-parents detail how they will share expenses in their parenting plan, a legal document co-parents submit within their marriage settlement. The language in the parenting plan is critical and will guide future financial decisions and outcomes.

Ultimately, the goal of sharing expenses in child custody is to ensure that the co-parents meet the child's financial needs to provide a supportive and stable upbringing.

To split expenses, co-parents consider factors like income and custody arrangements. Then, they try to make a system that fairly divides expenses between the two parties. It’s often not a 50-50 split. They detail their system in a parenting plan.

The default way co-parents split expenses is to use “pro rata” splits, or splitting costs according to each co-parent’s income. Co-parents generally divide expenses in proportion to each co-parent’s ability to contribute. Co-parents with joint custody also consider their specific custody arrangements when deciding how to create an equitable distribution of expenses.

Still, incomes can vary over time, and other issues can emerge. Splitting expenses with a co-parent first requires a basic understanding of the different expenses that can arise.

Here are common questions about splitting expenses with a co-parent.

The co-parenting shared expense list covers healthcare, education, extracurriculars, transportation, and more. It helps co-parents manage finances and meet their child's needs.

Here’s a list of commonly shared expense categories and possible expenses in each category. Please note that the list of potential expenses is not exhaustive and may vary based on individual circumstances and preferences.

Follow these tips to manage co-parenting expenses effectively: Communicate openly with the other parent. Keep track of expenses. Create a budget. Consider online tools. Above all, prioritize the child's needs. Collaboration and organization are key.

Here are detailed tips for managing co-parenting expenses straight from the experts:

Even when co-parents intentionally discuss future expenses, the conversation can be difficult to navigate alone. Questions like “Who will pay for college?” aren’t easy to answer.

That's why mediator Jennifer Warren Medwin strongly advises co-parents to seek the guidance of a divorce coach or a similar professional. Medwin stresses the importance of outside support.

Burchell adds: “To begin, your parenting plan should clearly outline the method of payment for reimbursement and establish a solid framework for handling shared expenses. Does your parenting plan clearly state whether both parents are contributing to all activities or only to agreed-upon activities? When it comes to the specifics of these expenses, it's essential to consider every detail meticulously.

Similarly, Burchell recommends discussing expenses within their broader categories. And, within each category, try to list everything that may come up, especially if one parent believes that the other may challenge the expense in the future.

“If you decide to share ‘educational expenses,’ does that include yearbook photos?” asks Burchell. “Maybe one co-parent naturally assumes yearbook photos are obviously an educational expense, and the other doesn’t. These gaps in detail are where conflict is born. Uniforms for school sports or rentals for musical instruments are other aspects that require careful consideration. In the realm of co-parenting, attention to detail is of utmost importance.”

Document everything

"Document, document, document!” Burchell advises. “Having clear records of bills and proof of payment can work wonders in resolving any legal conflict over financial responsibilities. Effective communication is key, and utilizing a co-parenting app that securely stores all messages can help maintain clarity and transparency."

“Put everything in writing” recommends Jon Stief, a family law attorney, mediator, forensic accountant and consultant . Jon has worked with thousands of clients, families and other family law professionals to resolve issues.

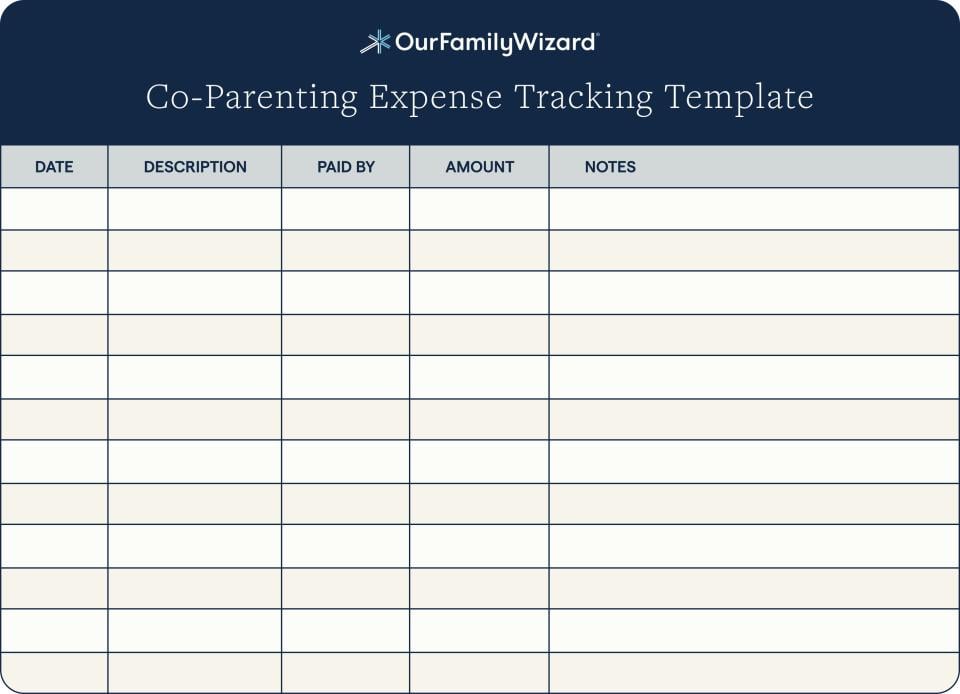

Download our Printable Co-Parenting Expense Log Template for Excel or make a copy of our Printable Co-Parenting Expense Log in Google Sheets to start tracking your co-parenting expenses today.

Open, honest communication is essential for managing disputes. Also, keep detailed expense records. Above all, co-parents should focus on the common goal: the child’s well-being. If needed, you can seek outside help to avoid returning to court.

Even co-parents in cooperative relationships must manage child expense disputes from time to time.

Here are a few tips for navigating conflicts when they do arise:

"In my experience, it’s helpful for co-parents to consider the circumstances of the other person involved," says Stief. "It's crucial to remember that there may be more going on behind the scenes than meets the eye. Perhaps it's a matter of timing, and the other parent wouldn't mind contributing if suitable payment arrangements are made. Taking a moment to empathize and understand their perspective can go a long way in finding common ground."

Medwin emphasizes the benefits of co-parents working together rather than going to court. "Engaging in a collaborative approach is far preferable. No one wants to bear the financial burden of attorney fees associated with litigation. Additionally, if you don't achieve the desired outcome, you may find yourself responsible for both the expenses you were disputing and the associated legal costs."

Stief points out that, along with a financial burden, litigation carries a significant emotional toll. “Litigation often leads to anger and resentment” says Stief. “It’s in your family’s best interest to avoid returning to court.”

Medwin adds: "On the other hand, if you are unquestionably in the right, resorting to court and holding the other party in contempt can serve as a powerful incentive for improved behavior in the future."

To create a budget, try digital tools like spreadsheets. On the spreadsheet, list anticipated expenses, consider each co-parent’s income, and regularly track and review actual costs. This practice will help you understand how much money you are spending.

Crafting a budget for co-parenting shared expenses can pose challenges, particularly when dealing with uncertain expenses or variable incomes.

Burchell says creating a budget can be challenging when you separate from a young child. “Unfortunately, you won’t have a crystal ball to predict what’s going to happen. Your 2-year-old hasn’t developed any expensive hobbies yet. They’re not going on trips to soccer tournaments or asking for expensive violin lessons. Plus, there are certain things you’ll never be able to predict, like a broken leg or arm.”

Burchell adds that planning with an older child becomes easier. In this case, it might be worth setting the time to make a budget. “If you split up with a 16-year-old, you probably already have a good grasp of their expenses. You can anticipate their medical bills and extracurricular commitments.”

If you’re interested in creating a budget, follow these steps:

Make co-parenting expenses effortless. Use OurFamilyWizard's user-friendly tools for managing expenses to track spending, request reimbursements, and support your child.

With OurFamilyWizard’s Expense Log , co-parents won’t need to deal with the hassle of manual spreadsheets and the risk of missed payments. The intuitive interface helps users track their shared costs with detailed expense reports and more.

The Expense Log calculates each co-parent’s expenses based on the expense category and approval status. This feature ensures fairness and transparency, preventing conflict before it can arise.

The Expense Log also offers a secure online payment option through OFWpay™. Co-parents can confidently make payments, knowing their financial account information remains private and secure. Additionally, the expense statuses are automatically updated upon payment, maintaining accurate records and eliminating the need for manual updates.

OurFamilyWizard simplifies the financial aspect of co-parenting and promotes effective communication and collaboration. By providing a centralized platform for co-parents to manage their shared expenses, OurFamilyWizard’s co-parenting app encourages an open and honest co-parenting commitment.

/sites/default/files/media/image/2023-05/headshot-rebecca-perra.jpeg

Rebecca Perra is a family law attorney as well as a family law and dependency mediator. She also serves as the Judicial Education Coordinator for OurFamilyWizard. In this role, she educates judges, lawyers, and other family law professionals on the online tools that are used to reduce conflict and increase accountability in high-conflict co-parenting situations.

OurFamilyWizard's Expenses tool helps you structure your co-parenting costs simply, quickly, and accurately.