In a deal that secured Kevin McCarthy the speakership, House Republicans plan to vote on the FairTax Act of 2023 (H.R. 25), which would replace almost all federal taxes with a 23 percent national retail sales tax, create a “Family Consumption Allowance,” a type of universal basic income, eliminate the IRS, and create a trigger to eliminate the sales tax if the 16 th amendment – which outlines Congress’s authority to levy an income tax – is not repealed in five years.

In a forthcoming study to be published in Tax Notes Federal, we analyze the FairTax and find the proposed tax rate is far too low to achieve its sponsors’ stated goal of deficit neutrality.

The bill’s cited rate of 23 percent is “tax-inclusive,” meaning the tax is 23 percent of the total after-tax price. This corresponds to a 30 percent “tax-exclusive” rate, or the markup at the cash register. These rates, however, would be insufficient to replace current law income, payroll, and estate and gift tax revenue.

As explained in previous research, FairTax proponents made a mathematical or logical mistake when they calculated the required rate. When estimating government revenues under the sales tax, advocates implicitly assumed that consumer prices (what consumers pay, including the sales tax) would rise by the full amount of the sales tax and that producer prices (what producers receive, net of the sales tax) would remain constant. But when estimating government spending, they implicitly assumed the opposite: consumer prices would remain constant and that producer prices would fall by the full amount of the tax. These assumptions are inconsistent and understate the tax rate required to maintain inflation-adjusted government spending and revenues.

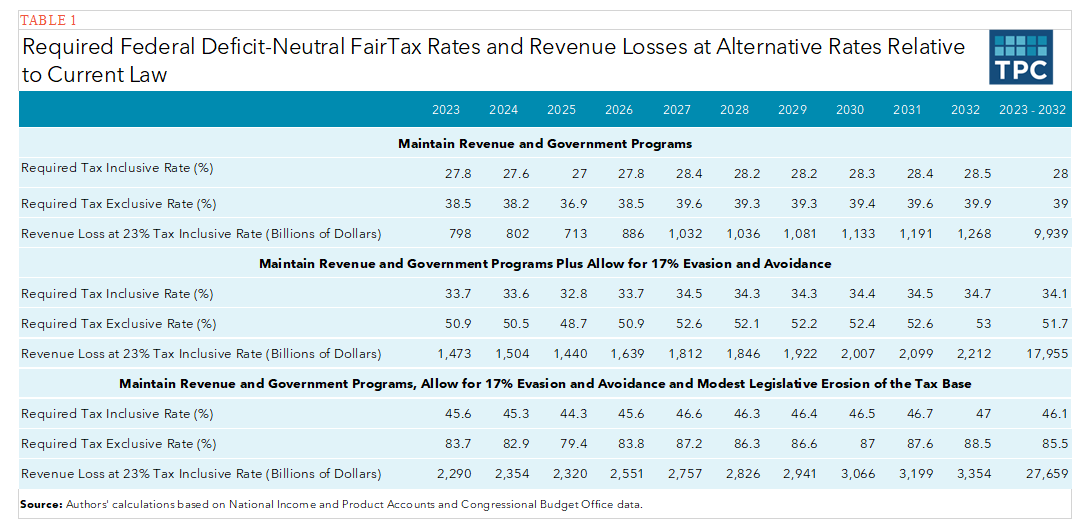

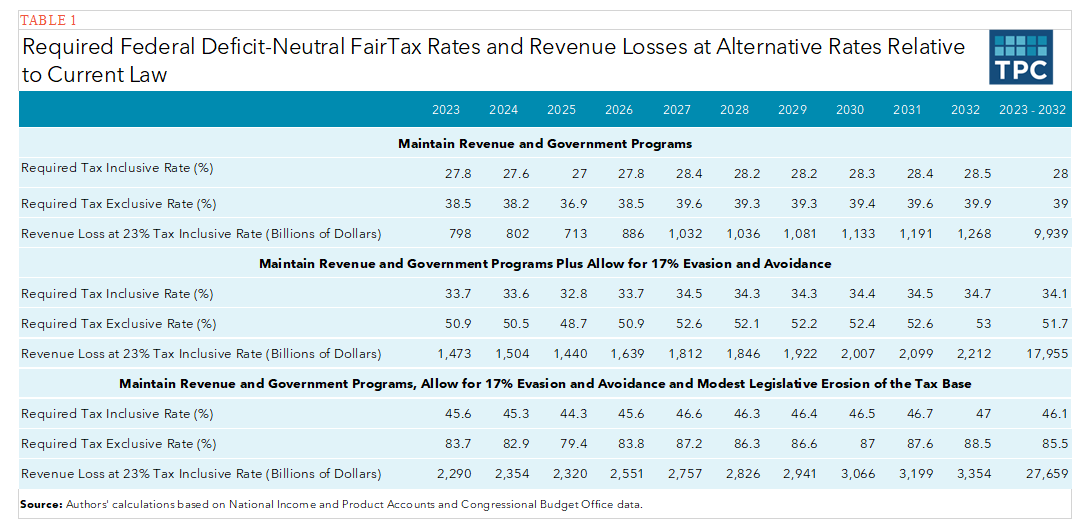

Correcting this mistake, we find that if the tax-inclusive rate remained 23 percent, federal deficits would rise by nearly $10 trillion over the next decade. The FairTax would require a tax-inclusive rate of about 28 percent over the next decade, corresponding to a 39 percent tax-exclusive rate but even that rate would only be deficit neutral under the extremely optimistic assumption that there would be no tax avoidance (which is legal) or evasion (which is not).

Of course, no tax is free of evasion or avoidance, and the FairTax offers ample opportunities for both. High-rate retail sales taxes are difficult to administer, most notably because there is no third-party reporting of tax liability. In the current income tax, the evasion rate is about 1 percent when there is third-party reporting and withholding (primarily on wages) but exceeds 50 percent when neither feature is present (primarily farms and sole proprietorships). Abolishing the IRS is not going to help enforcement or discourage tax cheats, either.

If one assumes that the FairTax would generate the same 17 percent rate of evasion as the income tax, the required-tax inclusive rate rises to 34.1 percent, or a 51.7 percent markup at the cash register). Under these avoidance and evasion assumptions, the revenue loss of a 23 percent tax-inclusive rate would equal almost $18 trillion over the next decade.

However, accounting only for evasion and avoidance may still be too optimistic. If the FairTax base is reduced by exempting state and local governments (or rebating their FairTax payments) and a small portion of necessities (which is common at the state level), the required deficit-neutral rate rises to 46.1 percent (tax inclusive), or an 85.5 percent tax exclusive rate. This would push the ten-year budget shortfall under a 23 percent tax-inclusive rate to approximately $27.7 trillion.

Many of the other purported benefits of the FairTax are overstated or illusory. The amount that the FairTax would reduce complexity in the tax code would be limited if states and localities kept their income taxes. In addition, sales taxes themselves are complex to administer. Replacing the income tax with a consumption tax would encourage saving and investment, but a sales tax would still distort work incentives. We estimate that the Fair Tax would place a slightly higher tax burden on labor than current law. Lastly, the FairTax would be less progressive than current law and create many winners and losers.

Although there are problems with the FairTax, there are still virtues to well-structured consumption-based taxes. A broad consumption-based tax, such as the value-added taxes in place in all other advanced countries, would raise a significant amount of revenue without distorting saving and investment decisions. This revenue could be used to reform existing taxes, reduce the deficit, and pay for new federal programs. Modest reforms to the income tax that move in the direction of a consumption tax could improve the tax code. For example, replacing the corporate income tax with a cash-flow tax would allow the federal government to collect tax revenue from businesses without distorting investment decisions. The FairTax does not add up and, as a fundamental tax reform, is essentially unworkable.

Gale holds the Miller Chair at the Brookings Institution and serves as codirector of the Urban-Brookings Tax Policy Center. Pomerleau is a Senior Fellow at the American Enterprise Institute. The authors thank Nora Cahill and Grant Seiter for research assistance, and John Buhl and Tara Watson for comments.